Since the mass shooting at Robb Elementary School in Uvalde, Texas, and the proposed “assault weapons” ban passed by the US House of Representatives earlier this year, gun researchers have noted a substantial increase in gun sales.

While not particularly well-known outside of the gun community, this phenomenon (what economists would call a “demand shock”) is common. These shocks are not limited to national tragedies and are observed during other significant events (e.g., legislation and political campaigns).

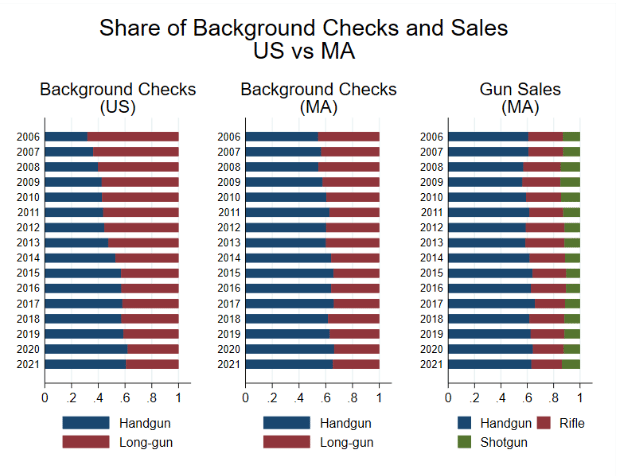

There is a problem with identifying these shocks stemming from the lack of detailed data regarding changes in gun prevalence. While the Federal Bureau of Investigation (FBI) publishes National Instant Criminal Background Check (NICS) counts that provide insight into sales by state, month, and type, the public information is only available at the state and national levels. It is also less than ideal when it comes to firearm type, differentiating only by handgun and long gun. Stated differently, the best information this data can provide is the number of background checks for a specific gun type (e.g., handgun) conducted in a given state in a given month of a specific year.

For a more detailed look at the short-run fluctuations of gun sales, we turn instead to firearm transaction-level data from Massachusetts. This data was originally obtained through a Freedom of Information Act request sent in the Summer of 2022. Shortly thereafter, the data was made public–coming from the Massachusetts electronic license check system. This data exists due to state law requiring all transfers (e.g., sales, inheritance, etc.) to be reported to the Department of Criminal Justice Information Services Firearms Records Bureau. Sales also require a Firearms Identification Card. Since 2015, the state also requires all transfers to be submitted online.

The public data is semi-anonymized; detailed information about the seller, if the transfer is through a licensed dealer, is included and all information about the buyer is omitted. The existence of this data is controversial and consequently very rare. With it, researchers are given a detailed window into the firearm market and can rigorously explore topics that would be impossible to do so otherwise. Others note that this database effectively serves as a gun registration, which is why similar information collected by the FBI is destroyed, and potentially lead to incorrect policy conclusions due to the database including only legal transfers.

The main advantage of the Massachusetts data set is that it is much finer than the FBI data and contains information about what firearms were sold (e.g., Ruger Mini-14, Browning Hi-Power, etc.), the date of the sale, and where the firearm was purchased (e.g., Bass Pro, Walmart, etc.). This is much more detailed information when compared to the NICS data. Not only does it include completed transactions, rather than checks that might not result in a sale, but it also provides what exact firearms were sold, on what specific date, and where the firearms were sold.

While Massachusetts’s liberal gun-control policy certainly affects firearm sales, the demand shocks caused by national events are still present in this data. However, it must be emphasized this data only reflects transactions taking place at licensed dealers. Therefore, extrapolation to national trends or the gun market, in general, must be taken with some caution. Whether these shocks are more apparent when including private transactions or are greater in other states with different gun laws is an open question.

We start with a basic comparison of the NICS and transaction data – with the latter being aggregated in a way to make the datasets comparable. Overall, the firearm sales data from Massachusetts matches the Massachusetts background check numbers reported by the FBI. The share of handgun and long gun sales match NICS checks, but the correlation between the number of background checks and total monthly sales is .98–verifying the accuracy of the sales data.

Interestingly, when comparing the background checks in Massachusetts to national figures, Massachusetts is not representative of the United States. While the United States is moving in the direction of Massachusetts (exhibited by a growing share of checks involving handguns), historically checks involving long guns (rifles and shotguns) tended to be more common than background checks involving handguns. This was not the case in Massachusetts which has historically seen handguns make up about 60 percent of dealer sales.

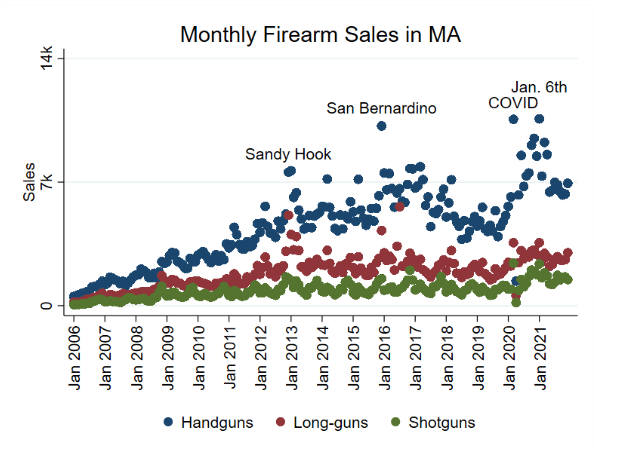

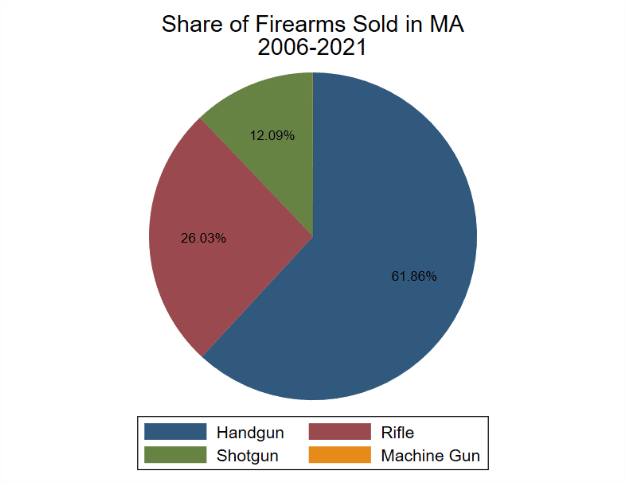

From 2006 to 2021, nearly 1.4 million firearms were sold/transferred by licensed dealers in Massachusetts. In 2006, 17,125 guns were sold (10,410 handguns, 5 machine guns, 4,500 rifles, and 2,210 shotguns). By 2021, this had increased to 140,229 guns (88,578 handguns, 11 machine guns, 32,463 rifles, and 19,177 shotguns). That comes out to about 8,000 more guns sold per year on average.

However, there is a lot of variation. Broadly speaking, sales increases tended to be the largest in the years prior to the 2016 election and the second half of former president Donald Trump’s term. In between those periods, sales fell and remained muted.

There were also short-run fluctuations during that time. Significant spikes corresponded with major news events. Notably, clear spikes occurred in the aftermath of the Sandy Hook and San Bernardino massacres. There are multiple reasons for these runs. Arguably, the three most commonly cited ones are fear of new gun control legislation that would prevent a future purchase, protest purchases against proposed legislation, and individual concerns for safety.

However, attributing sales spikes to specific events is often more complicated than one might expect as eye-catching events often occur in rapid succession.

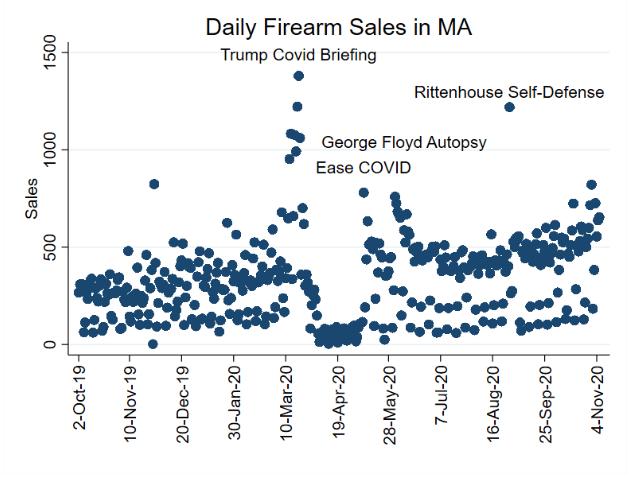

To illustrate, consider 2020. Firearm sales spiked on March 20, 2020, after former President Donald Trump’s COVID-19 announcement, and plummeted during the shutdowns occurring soon after the announcement. Gun sales spiked once these restrictions were lifted but quickly fell suggesting the rise in firearm sales was not a typical increase in demand but rather pent-up demand being resolved.

This drop was very temporary as sales increased once again in the wake of George Floyd’s murder. Sales quickly fell again then continued an upward trend towards the end of 2020. But another notable spike corresponded with the announcement of Kyle Rittenhouse’s self-defense plea after he shot Joseph Rosenbaum and Anthony Huber during rioting in Kenosha, Wisconsin.

But not all gun sales were equally impacted by national events. Handgun sales seemed to be the most influenced by highly publicized events while shotguns had consistent sales growth with little variation. Rifle sales fell somewhere in the middle. Rifle sales were dominated by the Smith & Wesson M&P15 (an AR-15 style rifle) and the Ruger 10/22 (often considered a starter rifle), which are generally less responsive to events than handguns.

High-profile mass shootings are a notable exception. Curiously, not every mass shooting translated to increased rifle sales–suggesting some level of satiated demand. This is particularly the case with mass shootings occurring soon after a different shooting or some other national event (e.g., new legislation).

Overall, the Massachusetts firearm transaction data show firearm sales increased alongside population growth. Sales also often spike in the run-up to national elections or the aftermath of a national news event that drives people to look for ways to protect themselves, such as riots or mass shootings. The shocks caused by those events are seen over and over again, but they only last a short time.